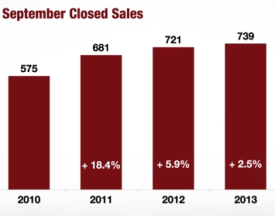

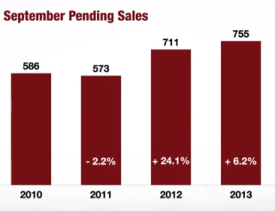

In what must be described as a newsworthy month for the Albany-Saratoga metro housing market, home prices dipped in September for only the second time in the last 18 months. Sixteen out of the last 18 months the Albany-Saratoga metro housing market has seen monthly price gains as compared to the same month the year before. This September home prices slipped 3.5% to a median sales price of $194,950, as compared to $202,000 last year and $188,100 in September 2011. At the same time pending home sales increased 6.2% to 755 signed contracts. This compares to 711 pending sales contracts last September and 573 pending sales contracts in September 2011. The Albany-Saratoga metro home sales (final sales as opposed to pending sales) also rose to 739 closed home sales in September, compared to 721 closed home sales in September 2012 and 681 closed homes sales in September 2011.

In what must be described as a newsworthy month for the Albany-Saratoga metro housing market, home prices dipped in September for only the second time in the last 18 months. Sixteen out of the last 18 months the Albany-Saratoga metro housing market has seen monthly price gains as compared to the same month the year before. This September home prices slipped 3.5% to a median sales price of $194,950, as compared to $202,000 last year and $188,100 in September 2011. At the same time pending home sales increased 6.2% to 755 signed contracts. This compares to 711 pending sales contracts last September and 573 pending sales contracts in September 2011. The Albany-Saratoga metro home sales (final sales as opposed to pending sales) also rose to 739 closed home sales in September, compared to 721 closed home sales in September 2012 and 681 closed homes sales in September 2011.

So what’s going on, is this price slip a leading indicator? Probably not, home prices likely moderated because of the increase in interest rates. Interest rates have climbed nearly a point (1.0%) – significantly increasing the cost of home purchases. Looking at the chart below, one year ago mortgage rates were hovering around 3.5% today they are at 4.25%. From a buyer’s point of view, a $200,000 mortgage at a 30 year fixed interest rate of 4.25% would be $984/mo versus a 3.5% interest rate mortgage of $898/mo. This difference in mortgage payments of $86/mo is equivalent to about $20,000 in purchasing power. Increasing the home mortgage interest by 0.75% reduces the purchasing power of buyers by about $20,000 for a $220,000 loan. All things considered a $7,000 price slip in median home sales price doesn’t look so bad when you consider it in the context of a 0.75% hike in mortgage interest rates.

So what’s going on, is this price slip a leading indicator? Probably not, home prices likely moderated because of the increase in interest rates. Interest rates have climbed nearly a point (1.0%) – significantly increasing the cost of home purchases. Looking at the chart below, one year ago mortgage rates were hovering around 3.5% today they are at 4.25%. From a buyer’s point of view, a $200,000 mortgage at a 30 year fixed interest rate of 4.25% would be $984/mo versus a 3.5% interest rate mortgage of $898/mo. This difference in mortgage payments of $86/mo is equivalent to about $20,000 in purchasing power. Increasing the home mortgage interest by 0.75% reduces the purchasing power of buyers by about $20,000 for a $220,000 loan. All things considered a $7,000 price slip in median home sales price doesn’t look so bad when you consider it in the context of a 0.75% hike in mortgage interest rates.

The cooling off in price may just be a healthy correction. But it may not last long as buyers adjust their expectations. The most important leading indicator, pending home sales was up for the month of September. However, in light of the mutli-week government shutdown-showdown we could see a down month when the October numbers are released next month. There will be bumps in the road, but in the end the strong trend in the line continues to head in a positive direction. Overall the improvement in the Albany-Saratoga metro housing market is accompanied by continued growth in the stock market and positive economic indicators.

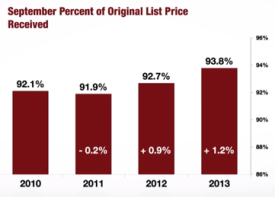

Finally the number sellers most care about, sale price to list price ratio, also rose in September by 1.2%. Sellers are getting 93.8% of their original list price at the time of the final sale. We’ve seen the era of multiple offers is back, and as a result we’ve even seen homes go above asking price. Monticello has represented multiple sellers this year who have sold their homes above asking price. So if you’re buyer and you stumble upon the right house at the right price, you may want to move quickly or risk paying more in the future.

Finally the number sellers most care about, sale price to list price ratio, also rose in September by 1.2%. Sellers are getting 93.8% of their original list price at the time of the final sale. We’ve seen the era of multiple offers is back, and as a result we’ve even seen homes go above asking price. Monticello has represented multiple sellers this year who have sold their homes above asking price. So if you’re buyer and you stumble upon the right house at the right price, you may want to move quickly or risk paying more in the future.

As always, if you have questions or concerns don’t hesitate to contact us. To search for all that declining inventory of available homes for sale, check out the search pages.

Below is the latest Great Capital Association or Realtors market skinny. For more detailed market numbers, you can visit the Albany County market page or the Saratoga County market page, with links to the specific micro markets.