Here are the latest numbers from the Greater Capital Association of Realtors (GCAR) to keep you in the loop on what’s happening in our local market—and how it stacks up nationally.

Capital Region Snapshot (April 2025)

- Pending Sales: Up 5.7% from last year, reaching 9,461, signaling a market waking up from its winter lull.

- Closed Sales: Down 10.5% to 6,641, though the rise in pending sales hints at a potential rebound.

- Inventory Levels: Increased 1.5% to 1,661 units, offering buyers a bit more choice.

- Median Sales Price: Rose 13.4% to $330,000, showing resilience despite growing inventory and affordability challenges.

- Percent of Original List Price Received: Slipped slightly to 98.9%, but remains competitive.

- Months Supply of Inventory: Held steady at 1.9 months, unchanged from last year.

County Highlights for April 2025

Albany County

New listings stayed at 246, with closed sales down 1.3% to 152. Months supply of inventory dropped 10.9% to 1.0, and days on market shortened to 25. The median sales price rose 5.7% to $343,500, with sellers receiving 100.3% of their original list price.

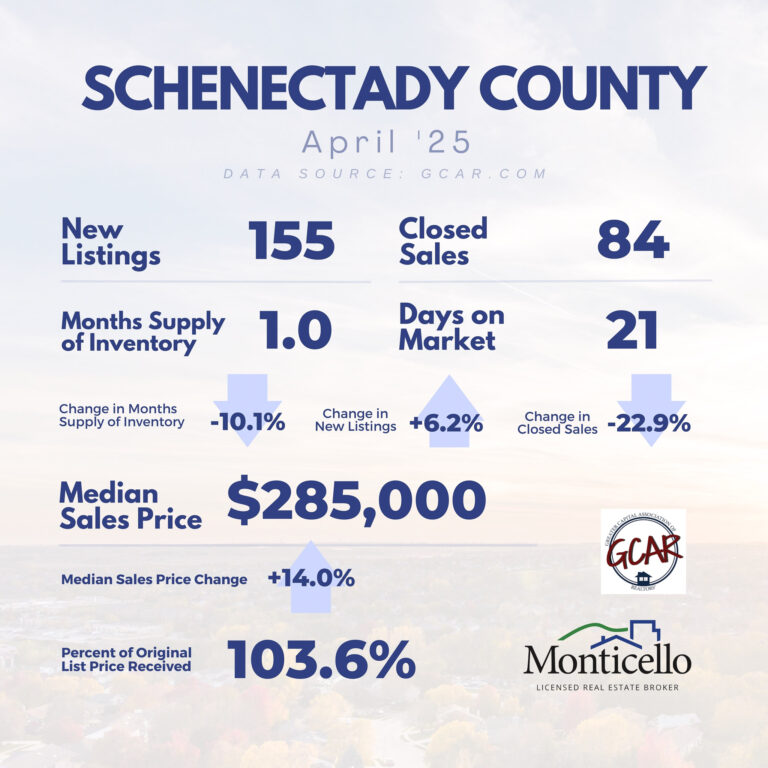

Schenectady County

New listings grew 6.2% to 155, but closed sales dropped 22.9% to 84. Months supply of inventory fell 10.1% to 1.0, with days on market at 21. The median sales price surged 14.0% to $285,000, and sellers received 103.6% of their original list price.

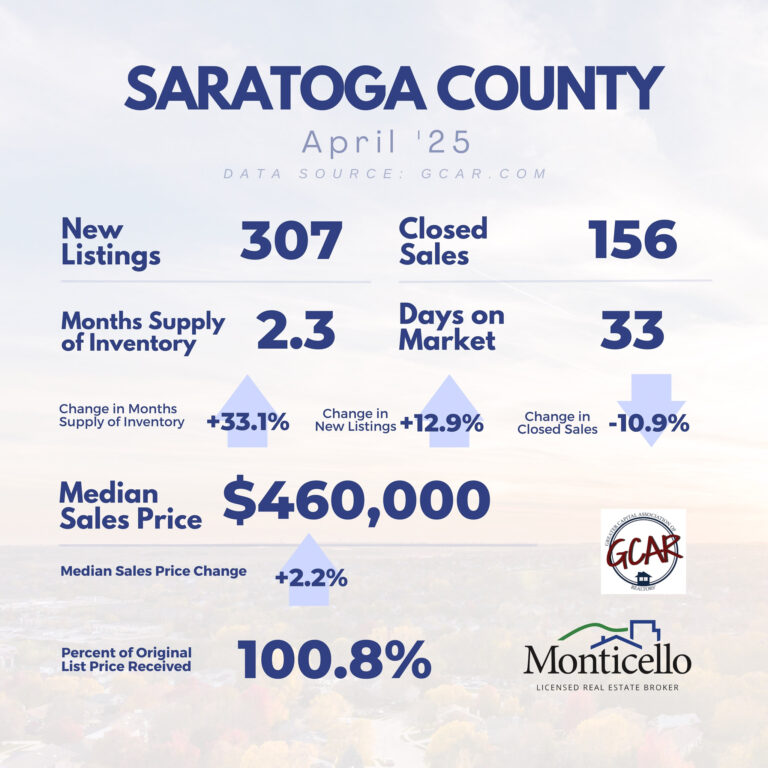

Saratoga County

New listings increased 12.9% to 307, while closed sales fell 10.9% to 156. Months supply of inventory rose 33.1% to 2.3, with days on market at 33. The median sales price grew 2.2% to $460,000, with sellers getting 100.8% of their original list price.

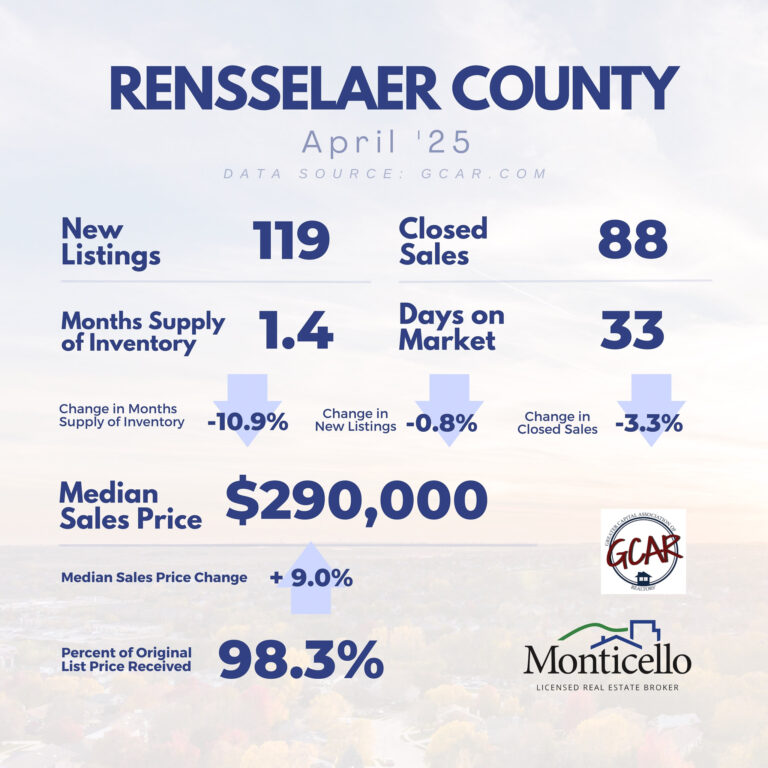

Rensselaer County

New listings decreased 15.3% to 116, and closed sales dipped 2.7% to 73. Months supply of inventory fell 7.8% to 1.4, with days on market at 30. The median sales price rose 6.3% to $289,000, and sellers received 99.6% of their original list price.

National Context

🔍 Home prices continue to rise despite an increase in inventory and affordability challenges, reflecting strong demand in a shifting market. For more details, check the full Capital Region Skinny video at gcar.com.

The takeaway? The market is stirring after winter, with inventory slowly growing, but prices remain robust as buyers compete for homes. Stay tuned for next month’s update!

For the full Capital Region Skinny video and data, visit gcar.com.