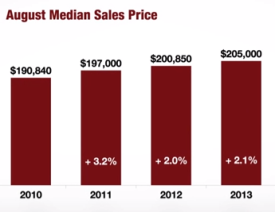

Yet again, Albany home prices increased in August as compared to the same month last year, marking the 18th month of year over year price gains during the last 19 months. In August, Capital Region home prices edged up 2.1% to $205,000. Not only did Albany prices rise, but so did closed sales, pending sales, and the list price to sale price ratio (percentage of asking price sellers are getting at closing). The total number of homes sold in the Capital Region rose 3% to 976, an improvement of 30 more sales than August 2012. August pending home sales rose 5.1% to 868 new sales contracts for the month. This is the highest August pending home sales number since 2007 for the Albany area. Finally, the competitive market has made for more balanced negotiations, with sellers getting 93.3% of their list price, up just 0.3% since August of last year – a 4 year high.

Yet again, Albany home prices increased in August as compared to the same month last year, marking the 18th month of year over year price gains during the last 19 months. In August, Capital Region home prices edged up 2.1% to $205,000. Not only did Albany prices rise, but so did closed sales, pending sales, and the list price to sale price ratio (percentage of asking price sellers are getting at closing). The total number of homes sold in the Capital Region rose 3% to 976, an improvement of 30 more sales than August 2012. August pending home sales rose 5.1% to 868 new sales contracts for the month. This is the highest August pending home sales number since 2007 for the Albany area. Finally, the competitive market has made for more balanced negotiations, with sellers getting 93.3% of their list price, up just 0.3% since August of last year – a 4 year high.

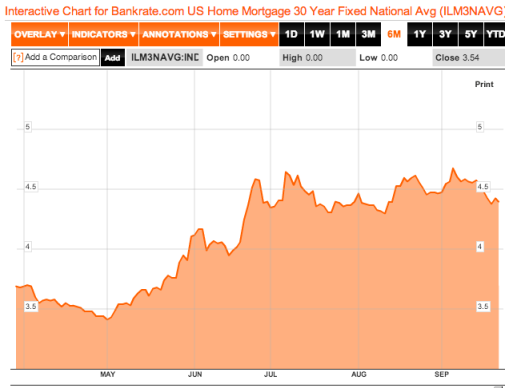

Although Albany home prices, final home sales, pending home sales, and the sale to list price ratio continued to improve, the rate of growth is slowing. The slowdown in the Capital Region housing market can best be attributed to the rising interest rates. Interest rates haven risen nearly a full point (1.0%) since April of this year. The rising interest rates have made home ownership more expensive and has likely forced buyers to consider less expensive properties.

Although Albany home prices, final home sales, pending home sales, and the sale to list price ratio continued to improve, the rate of growth is slowing. The slowdown in the Capital Region housing market can best be attributed to the rising interest rates. Interest rates haven risen nearly a full point (1.0%) since April of this year. The rising interest rates have made home ownership more expensive and has likely forced buyers to consider less expensive properties.

As of today the national daily average for the 30 year fixed mortgage interest rate is 4.39%, down from 4.67% on September 5th of this year. The old saying that interest rates take the elevator up and stairs down, seems to hold true today. Rates have moved only slightly down, despite the surprise move by the Federal Reserve to continue it’s QE 3 program. Since June 25, rates have been hovering around 4.5% with subtle fluctuations. Any move in the interest rate downward will likely only be temporary. But of course a mortgage interest rate is only one of many factors homebuyers have to consider when purchasing a new house. Below is a chart of the 6 month daily average for US home mortgage rates for the 30 year fixed mortgage.

As the selling season begins to wind down, interest rates may play a larger role in pushing buyers into a decision before the end of the year. We’ve said it before, now is the time to snatch up some of the last remaining deals of the season, as more buyers exit the market and the cold weather begins to chill sellers’ confidence. For sellers, especially homes that have come on the market in the last four weeks, several weeks of the buying season remain. October is the last month of uninterrupted home sales, not encumbered by a major holiday. But as Thanksgiving nears, all eyes shift to the holidays and most buyers will likely suspend their search until after the new year. Here is to every buyer finding their home before the new year, and every seller finding their perfect buyer.

As always, if you have questions or concerns don’t hesitate to contact us. To search for all that declining inventory of available homes for sale, check out the search pages.

Below is the latest Great Capital Association or Realtors market skinny. For more detailed market numbers, you can visit the Albany County market page or the Saratoga County market page, with links to the specific micro markets.